Exchange Traded Funds (ETFs) are essentially open-ended funds that track/replicate certain indices such as Nifty50 index, S&P BSE SENSEX etc. and are listed and traded on exchanges like stocks.

ETFs enable investors to gain broad exposure to an index with relative ease, on a real-time basis and at a lower cost than many other forms of investing.

Think of it as a Mutual Fund that you can buy and sell in real-time at a price that change throughout the day.

- Diversification ETFs offer diversification benefit to investors as they invest in a well-diversified portfolio to the extent of the underlying index that they track.

- Transparency Both basket of the securities & cash component of the ETF are disclosed on daily basis on AMC website. Also, indicative NAV based on the valuation of the underlying securities is displayed on real-time basis.

- Low cost Generally ETFs are low cost since there is no active fund management in these schemes and as trading in these schemes is done through brokerage firms it reduces administration cost. However, please note that ETF's do incur transactional cost.

- Liquidity ETF are listed on the stock exchange and trade like a share during the market hours. Investors wishing to invest in ETF can invest at any time during the market hours at the prevailing market price either directly with the AMC (in creation unit size) or on the listed stock exchange (single unit).

-

Equity Funds

ETFs that track/replicate the equity index i.e. either market cap based or sector-based indices are termed as Equity Funds.

Equity Funds

ETFs that track/replicate the equity index i.e. either market cap based or sector-based indices are termed as Equity Funds.

-

Fixed Income

Fixed Income ETFs track/replicate indices whose constituents are fixed income securities such as government security, corporate bonds or money market securities

Fixed Income

Fixed Income ETFs track/replicate indices whose constituents are fixed income securities such as government security, corporate bonds or money market securities

-

Commodity

ETFs that track/replicate the price of a commodity such as gold are termed as commodity ETFs.

Commodity

ETFs that track/replicate the price of a commodity such as gold are termed as commodity ETFs.

An investor can invest in ETF’s either directly with the AMC or through the exchange.

Directly with the AMC: The authorized participant/large investor can buy/sell the ETF units directly with the AMC only in creation unit size at the applicable NAV of the Scheme.

On the Exchange: ETFs are listed on the exchange. Investor can buy/sell units on an ongoing basis on NSE/BSE at the prevailing trading prices.

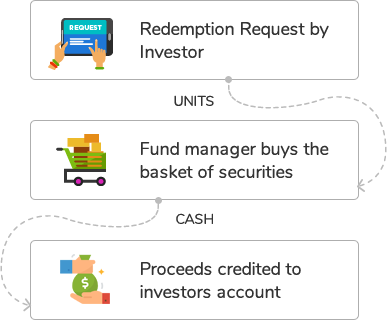

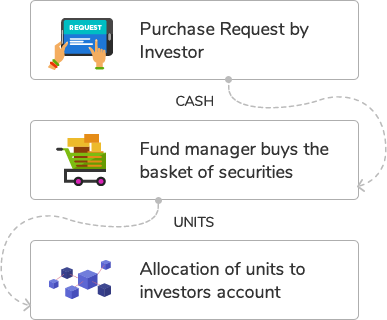

The process of purchase an redemption in ETFs through an AMC can be explained by the chart below

- 1 Investor places a purchase order with the AMC by sending an application form indicating the investment amount or number of baskets he wishes to buy.

- 2 Upon confirmation of receipt of the order and the amount, the fund manager executes the transaction for the respective investor.

- 3 Considering that the ETFs are traded throughout the day like stocks, the investors trade gets executed at the prevailing market price at that point of time.

- 4 Upon execution of the transaction, each investor is provided a deal confirmation slip, which indicates the number of units purchased and the price at which they have been executed and the units are then allocated to investors demat account.

- 1 Investor sends a redemption request to the AMC and also transfers the ETF units to the AMC demat account.

- 2 Upon receipt of the units in the AMC demat account, the fund manager executes the sale transaction for the respective investor.

- 3 Upon execution of the transaction, investor is provided a deal confirmation slip, which indicates the number of units sold, the selling price, transaction cost and other details and the proceeds are then credited to the investors on settlement date.