ETF Functioning

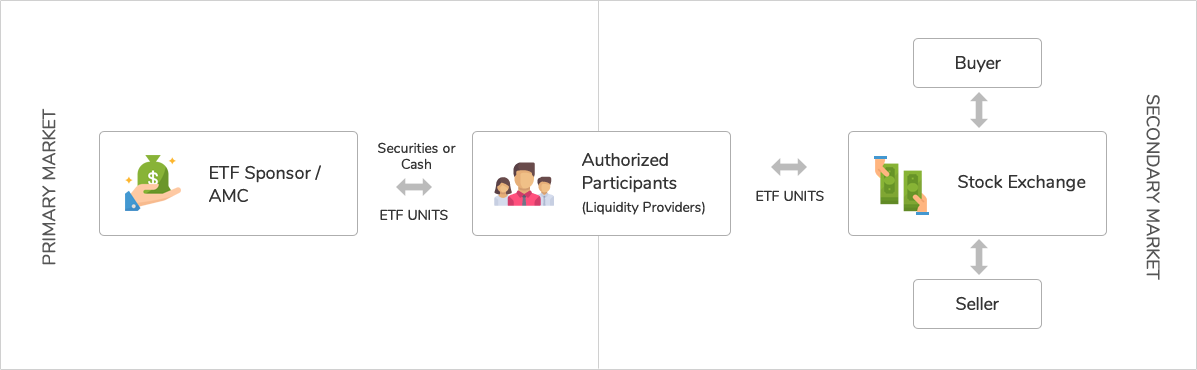

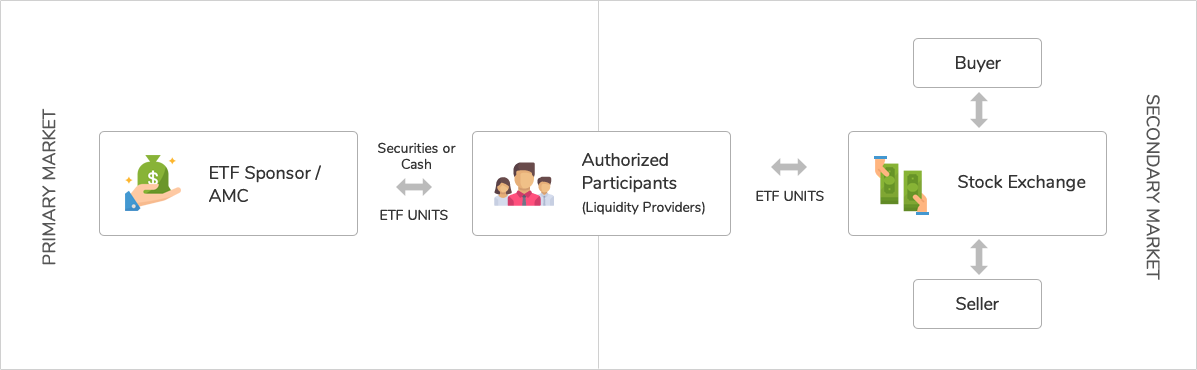

ETF functioning can be explained by the interaction between three key participants viz. Asset Management Company, Authorised Participants and the stock exchange where the ETFs are listed. Further, the ecosystem is divided as primary and secondary market based on the creation and redemption of units.

APs create liquidity in the primary and secondary market by exchange of securities or cash for ETF units. APs delivers the basket of securities (that make up the underlying index) in appropriate weightage to the AMC in exchange for units of ETF (creation unit size). APs can also transfer cash and get the require units of ETF in exchange. APs use these ETF units to provide liquidity in the secondary market. Investors can buy and sell these units on exchange through brokers.

The redemption process works exactly in reverse, where the APs acquire units of ETF in the secondary market and exchange them with the AMC for underlying securities in the appropriate weightage or cash, as the case may be.

APs create liquidity in the primary and secondary market by exchange of securities or cash for ETF units. APs delivers the basket of securities (that make up the underlying index) in appropriate weightage to the AMC in exchange for units of ETF (creation unit size). APs can also transfer cash and get the require units of ETF in exchange. APs use these ETF units to provide liquidity in the secondary market. Investors can buy and sell these units on exchange through brokers.

The redemption process works exactly in reverse, where the APs acquire units of ETF in the secondary market and exchange them with the AMC for underlying securities in the appropriate weightage or cash, as the case may be.

- 1 Investor places a purchase order with the AMC by sending an application form indicating the investment amount or number of baskets he wishes to buy.

- 2 Upon confirmation of receipt of the order and the amount, the fund manager executes the transaction for the respective investor.

- 3 Considering that the ETFs are traded throughout the day like stocks, the investors trade gets executed at the prevailing market price at that point of time.

APs create liquidity in the primary and secondary market by exchange of securities or cash for ETF units. APs delivers the basket of securities (that make up the underlying index) in appropriate weightage to the AMC in exchange for units of ETF (creation unit size). APs can also transfer cash and get the require units of ETF in exchange. APs use these ETF units to provide liquidity in the secondary market. Investors can buy and sell these units on exchange through brokers.

The redemption process works exactly in reverse, where the APs acquire units of ETF in the secondary market and exchange them with the AMC for underlying securities in the appropriate weightage or cash, as the case may be.

APs create liquidity in the primary and secondary market by exchange of securities or cash for ETF units. APs delivers the basket of securities (that make up the underlying index) in appropriate weightage to the AMC in exchange for units of ETF (creation unit size). APs can also transfer cash and get the require units of ETF in exchange. APs use these ETF units to provide liquidity in the secondary market. Investors can buy and sell these units on exchange through brokers.

The redemption process works exactly in reverse, where the APs acquire units of ETF in the secondary market and exchange them with the AMC for underlying securities in the appropriate weightage or cash, as the case may be.

ETF Ecosystem

- AMC - The AMC manages the Exchange Traded Funds (in this case the AMC)

- Index Providers - Index providers are institutions that create and maintain equity and fixed income indices that the ETF aims to replicate.

- Authorised Participants - APs are trading participants authorised by the sponsor of the ETF to create and redeem ETF units in the primary market. Primary role of APs is to create liquidity of the ETF units in the market.

- Stock Exchange - Stock exchanges are the platform on which the ETF schemes are listed. An investor can trade in ETFs on exchange throughout the day at the prevailing market price.

- Brokers/Advisors - Investors can invest in ETFs through the secondary market by getting in touch with their brokers.